Debit & Credit User Guide

Statement Reconciliation

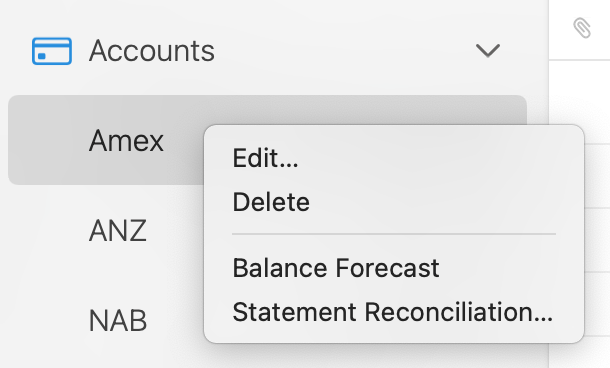

How to Start Reconciliation in macOS

Right click an account in the account list and select "Statement Reconciliation…". Alternatively, you can do that via the "Account" menu in the menu bar.

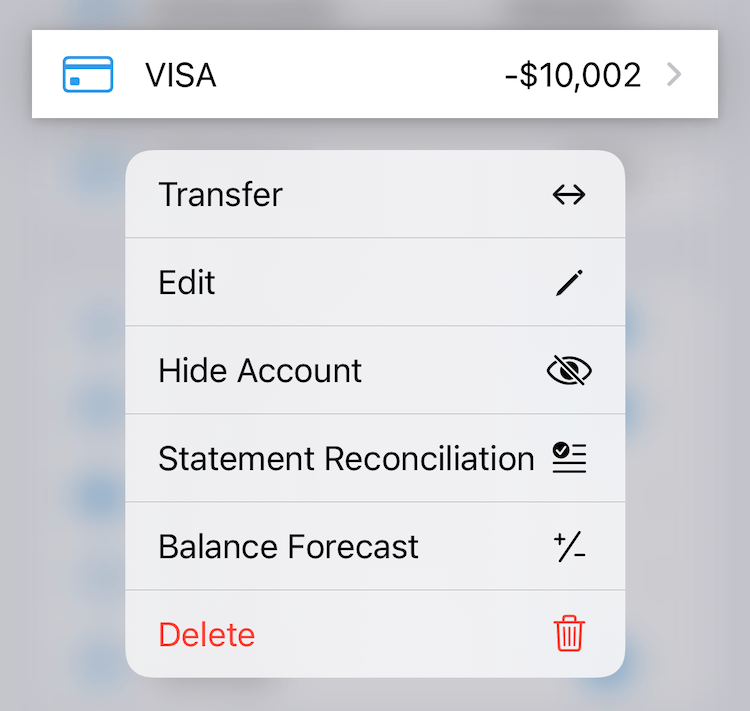

How to Start Reconciliation in iOS

Tap on hold on an account in the account list. Select "Statement Reconciliation".

Reconciliation Tutorial

Statement reconciliation in Debit & Credit consists of the following four steps:

1. Enter your statement data (opening and closing balance, start and end date). 2. Check transactions that fall into the statement period. You can do that using the "Check Matching Transactions" action that will check all transactions within the statement period. 3. Reconcile your transactions in the app with the statement transactions. You need to have the "Difference" figure equal to zero which means that the statement is reconciled. 4. Mark transactions you worked with as reconciled for your future reference.

Reconciliation Figures

Once you start reconciliation, you will notice that there are five additional figures displayed by the app in the bottom panel to help you reconcile your transactions:

Credits - a sum of checked transactions that have income nature. Debits - a sum of checked transactions that have expense nature. Total - your total balance for the period, the difference between debits and credits. Statement Total - the difference between the closing and the opening balance that you have provided as a part of your statement data. Difference - the difference between the statement total and the total calculated based on the checked transactions. It shows whether you have a disparity between your statement and existing data in the app. You need to have it equal to zero to finish reconciliation.

PDF Statements

On Mac and iPad, you can open a PDF statement and display it side by side with your transactions. This allows you to cross off transactions in the PDF while selecting them for reconciliation in the main list.

To mark a transaction in the PDF, double-click on Mac or tap and hold on iPad. To delete an annotation, click it to select it, then use the Delete button.

You can also try automatically matching transactions in the PDF with transactions in your account. If successful, most of your transactions will be selected for reconciliation automatically, saving you significant time. However, this feature depends on your bank and on how the PDF statements are formatted.

PDF statements are available starting in app version 7.6 and require macOS 15 or iPadOS 26.

Additional Information

Here are some tips that might be useful to know when completing a statement reconciliation:

• once you mark transactions as reconciled and finish reconciliation, the closing balance for your account will be recorded by the app. It will be then used as an opening balance for the next reconciliation. • you can drag and drop transactions to rearrange them by date. That way you can make transactions order match your bank statement. • if you share an account with someone else you will see a filter option to show transactions only created by them. This is useful if your credit card has supplementary cardholders and their transactions are listed separately on a statement.

Related topics: transaction attachments, split categories, transaction tags.